Tax Exemption Portal Access

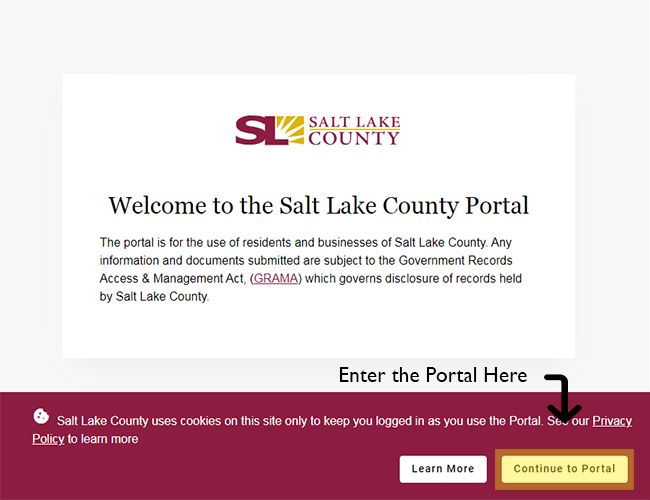

Go to the following link to begin the process: Tax Exemptions Portal

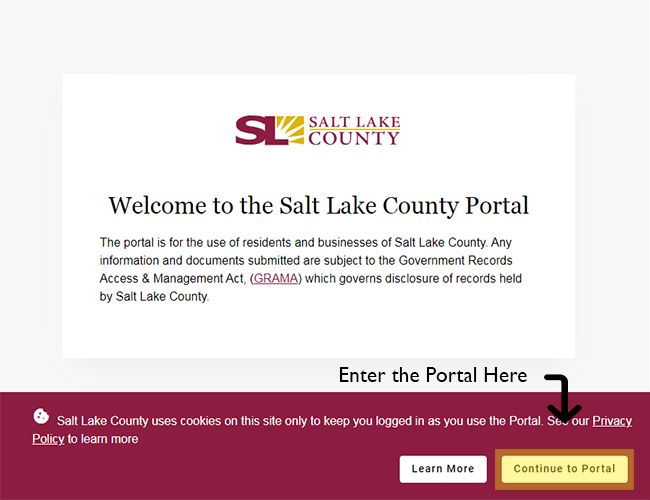

Select the "Continue to Portal" button at the bottom right of the splash screen.

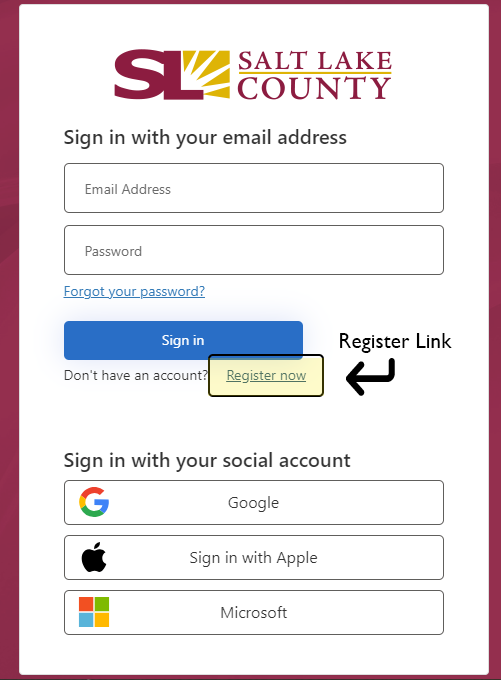

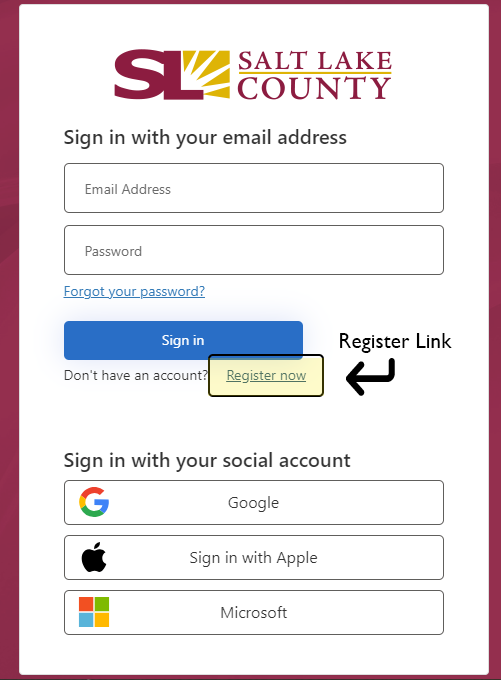

Start by selecting the Register Now link – Enter your organization’s email address on the next screen.

Note: If you have a social media account that uses the organizational email address, you may use that account to authenticate your email address instead of entering it manually. This will allow you to skip the email authentication step.

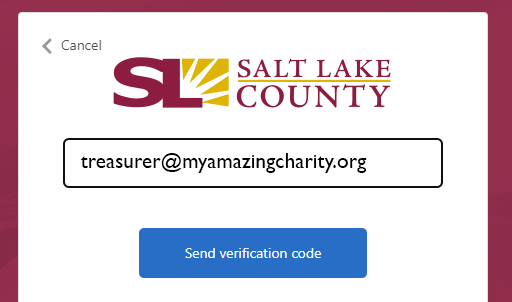

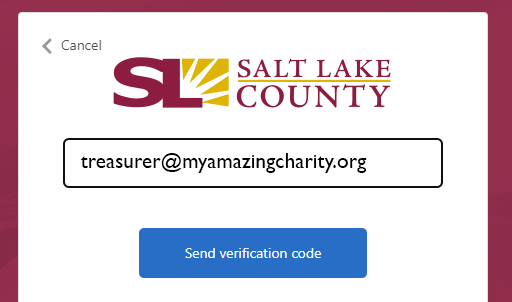

Enter your organization’s email address, then click “Send Verification Code”.

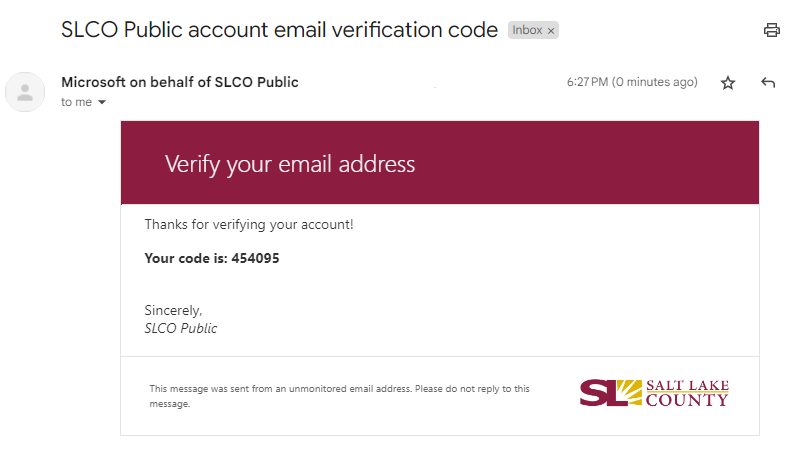

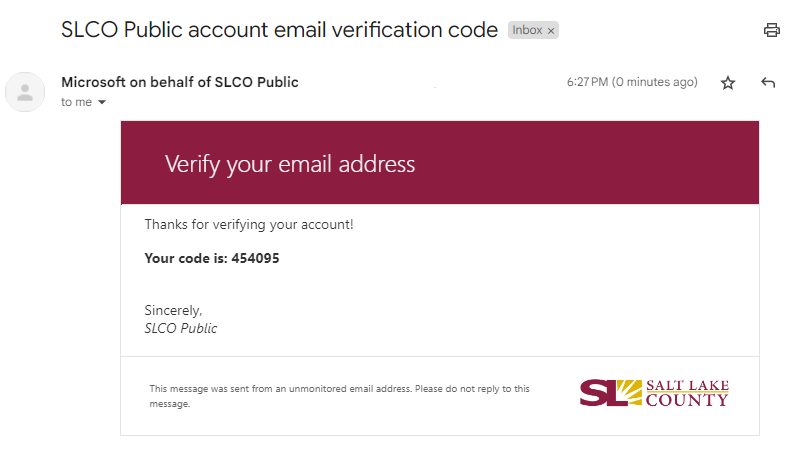

Then check your email for the verification code.

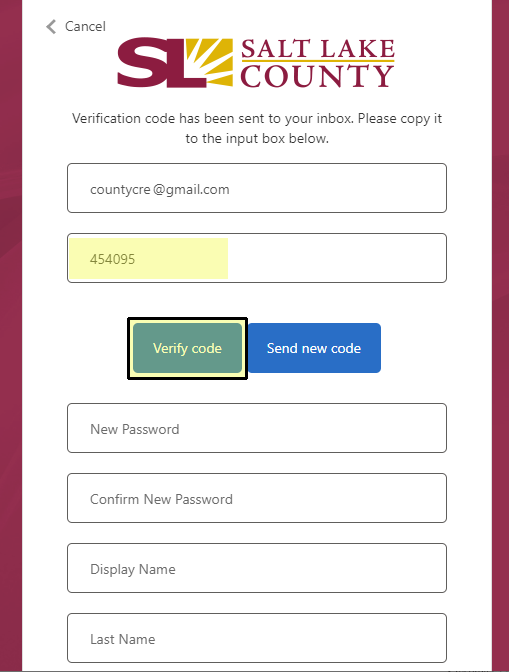

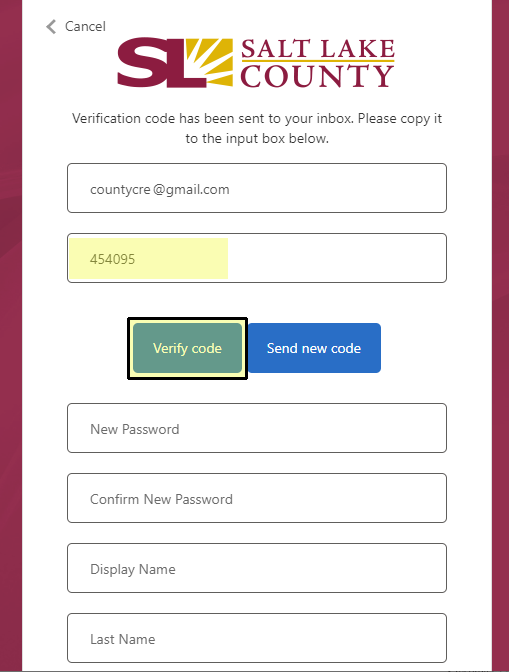

Return to the Portal and enter the verification code.

Once you click the “Verify Code” button, you will be able to fill in the rest of the form to create your user account. When you click “Create” at the bottom of the form, you will be taken to the main Portal Dashboard.

Next Steps

New Users - If you are a new user who has never created a tax exemption, your user account must be approved by the office of the Auditor before you can proceed.

Once you have been approved for an account, you will receive an email that will tell you that you have been allowed access to the CRE portal.

You will then be able to log back into the Portal and begin the process to create a New Organization account.

Current Users – If your organization already has an existing exemption account, you will be able to log in immediately to the Portal and manage your account. See the next section about the Annual Renewal Process.